Pursuant to Presidential Decree No. 9903 published in the Official Gazette dated 30 May 2025 and numbered 32915, Turkey’s investment incentive system has been restructured. This new system aims to support production, employment, digital and green transformation, and regional development objectives. In this context, Decree No. 2012/3305 and the Decree on the Attraction Centers Program No. 2018/11201 have been repealed.

Main Structure of the New Investment Incentive System

The new system consists of three main programs:

1. Türkiye Century Development Initiative

Technology Initiative Program: Focuses on medium-high and high-tech products. Projects are evaluated on a project basis by the Ministry. The list of priority products is updated every January.

Local Development Initiative Program: Aims to reduce interregional development disparities. Local investment topics are determined and supported based on the socio-economic structures of provinces.

Strategic Initiative Program: Covers investments contributing to strategic objectives such as supply security, reducing foreign dependency, and boosting exports. Minimum investment amount: TRY 100 million for high-tech investments; TRY 200 million for other investments.

2. Sectoral Incentive System

Priority Investments Incentive System: Covers areas such as R&D, high technology, mining, defense industry, data centers, energy, health, education, and care services for the elderly/disabled.

Targeted Investments Incentive System: Supports certain investment subjects if implemented in designated regions.

3. Regional Incentives

Turkey is divided into six regions according to socio-economic development levels. Each region is granted different types of support measures.

Incentive and Support Instruments

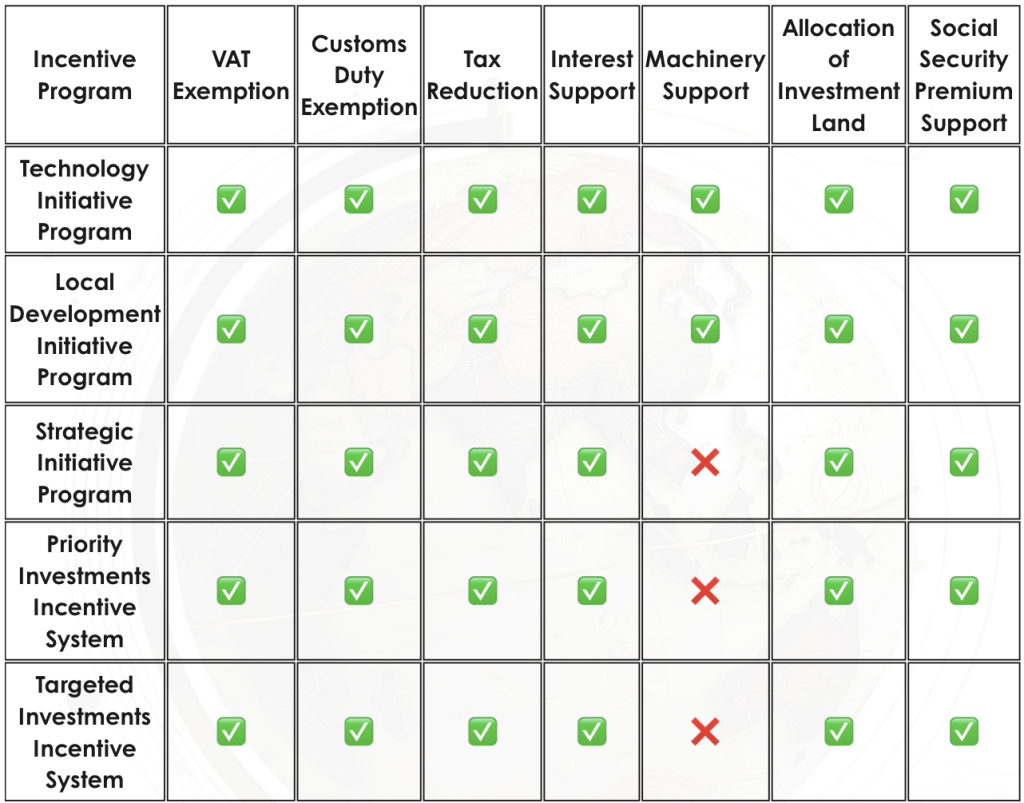

The following table summarizes the support instruments provided under each incentive program:

Note: Machinery support is only provided under the Technology and Local Development Initiative Programs.

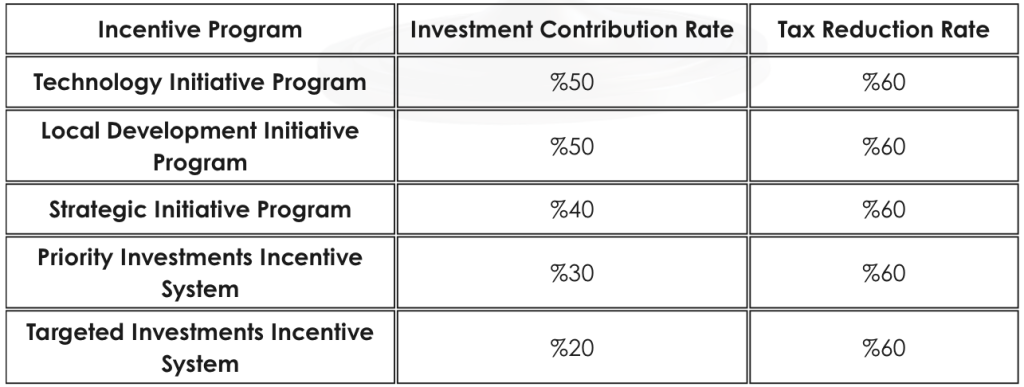

Tax Reduction and Investment Contribution Rates

The tax reduction and investment contribution rates determined for each incentive program are as follows:

The investment contribution rate indicates the extent to which the government will contribute to the total cost of the investment. The tax reduction rate, on the other hand, specifies the portion by which the tax payable on the income generated after the investment becomes operational will be reduced.

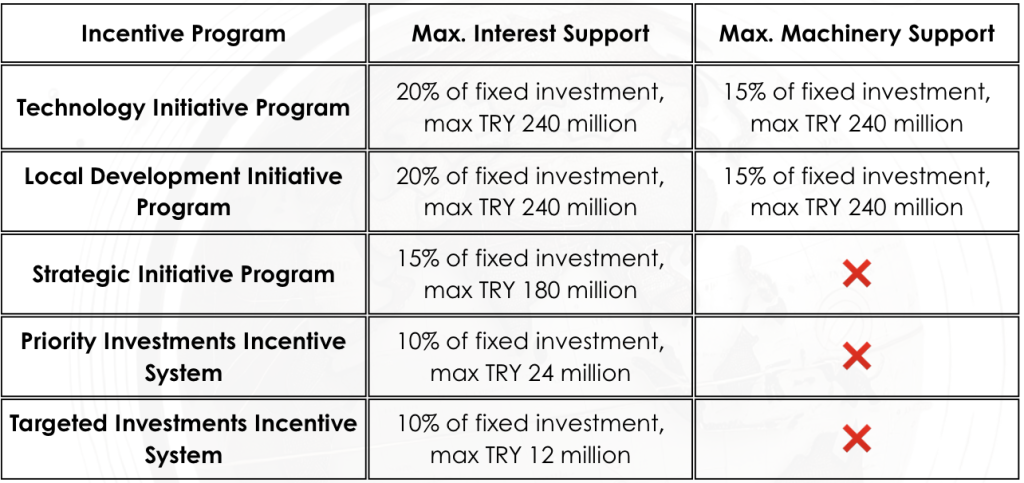

Limits for Interest and Machinery Support

The interest support and machinery support limits determined for each incentive program are as follows:

Note: Machinery support is only provided under the Technology and Local Development Initiative Programs.

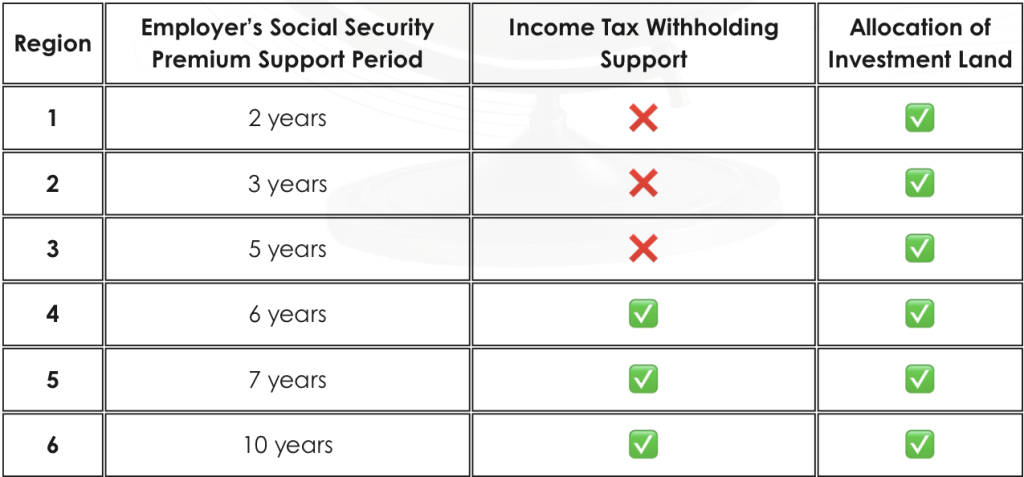

Regional Incentives and Social Security Supports

Turkey is divided into six regions based on socio-economic development levels. Each region is entitled to different support instruments.

Note: Additional supports are provided for investments carried out in Region 6.

Implementation Calendar and Validity

This comprehensive regulation entered into force on 30 May 2025 and is expected to remain valid until 31 December 2030. Applications for investment incentive certificates will be evaluated until 31 December 2030.

Conclusion

The new investment incentive system offers a comprehensive and goal-oriented structure aimed at supporting Turkey’s economic development objectives. Prioritizing strategic, technological, and regional investments, the system presents significant opportunities for investors and seeks to promote balanced growth across the country.

For more information and application procedures, please contact us at info@cetinavukatlik.com or visit the official website of the Ministry of Industry and Technology.

To get detailed information about the services of our office on the subject: